What You Need to Know

- The bill would limit annual costs to an inflation-adjusted $6,700.

- It would also create a Part E plan, open to all ages.

- Democrats have been pushing similar bills since 2017.

Democrats in Congress have revived an effort to protect Medicare enrollees from high medical costs.

Lawmakers’ new Choose Medicare Act bill would cap Medicare enrollees’ out-of-pocket costs at $6,700 per year starting in 2026. The bill would also create a Medicare Part E plan open to people of any age.

Today, people who sign up for original Medicare without buying supplemental coverage face unlimited exposure to “cost-sharing” bills.

Sen. Jeff Merkley, D-Ore., returned as the bill sponsor in the Senate. Rep. Jimmy Gomez, D-Calif., is back as the sponsor in the House.

What it means: If the bill passes, it could reduce clients’ need for either Medicare Advantage plans or Medicare supplement insurance policies.

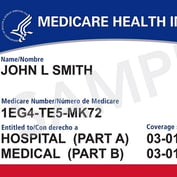

The bill: The Medicare Part A program pays for inpatient hospital bills. The Medicare Part B program pays for outpatient care and physician services.

More than 75% of the enrollees use Medicare Advantage plans, Medicare supplement insurance or programs aimed at low-income people to handle Medicare cost-sharing bills.

Medicare enrollees who have no supplemental coverage can end up owning tens of thousands or more on deductibles, coinsurance amounts and co-payments.

Johns Hopkins researchers found in 2017 that 10% of Medicare enrollees with no supplemental coverage who have cancer end up spending more than $17,866, or more than 63% of their total annual household income, on out-of-pocket medical costs.

June 03, 2024 at 02:25 PM

June 03, 2024 at 02:25 PM